Why invest in Mauritius?

Mauritius has long been a dream destination for travelers from all over the world, but it has also become a top choice for discerning real estate investors.

Facilitated procedures

Several residence permits for foreigners

Business

Ease of doing business

Conviviality

Events, atmosphere

Community

Large expatriate community

28°c

Average temperature

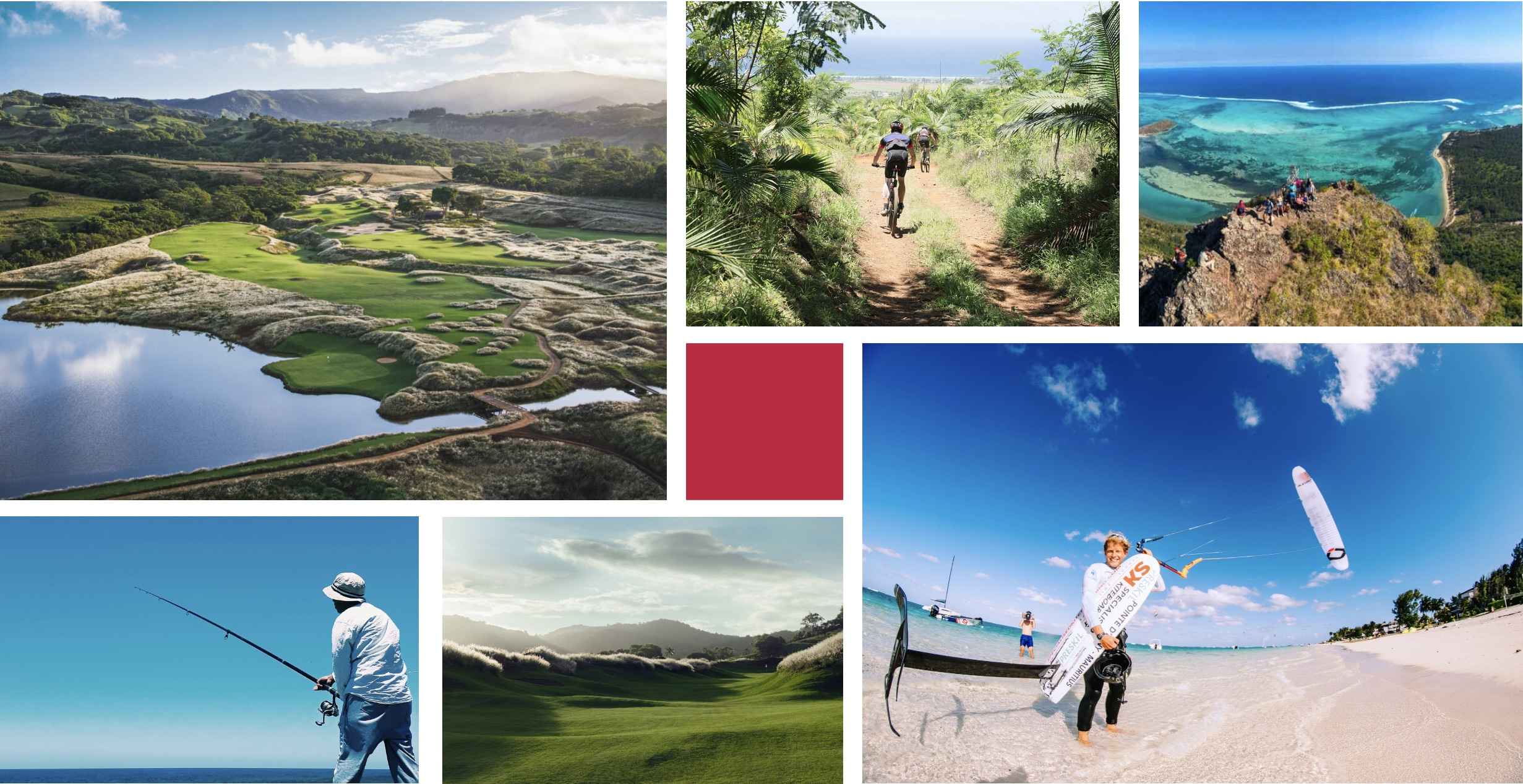

Entertainment

Cinemas, bowling, cultural activities, concerts, plays, exhibitions

GMT+4

Timezone

Lifestyle

Bars, restaurants, gyms...

Easier property acquisition for residents of Mauritius

Occupation and Resident Permit holders can now own their principal residence outside traditional schemes such as IRS, PDS, RES, R+2 and Smart City.

Property criteria

You can acquire a residential property built on a plot of up to 0.5276 hectares, a bare plot, or a serviced plot not exceeding 0.5276 hectares.

Price and taxes

The property must be worth at least 500,000 USD.

Soft taxation

- A single tax rate of 15% for individuals and companies.

- No inheritance tax.

- No capital gains tax on resale of the property.

- No property tax, no council tax.

- Free repatriation of profits, dividends and capital.