Why invest in Mauritius?

Mauritius has long been a dream destination for travelers from all over the world, but it has also become a top choice for discerning real estate investors.

Facilitated procedures

Several residence permits for foreigners

Business

Ease of doing business

Conviviality

Events, atmosphere

Community

Large expatriate community

28°c

Average temperature

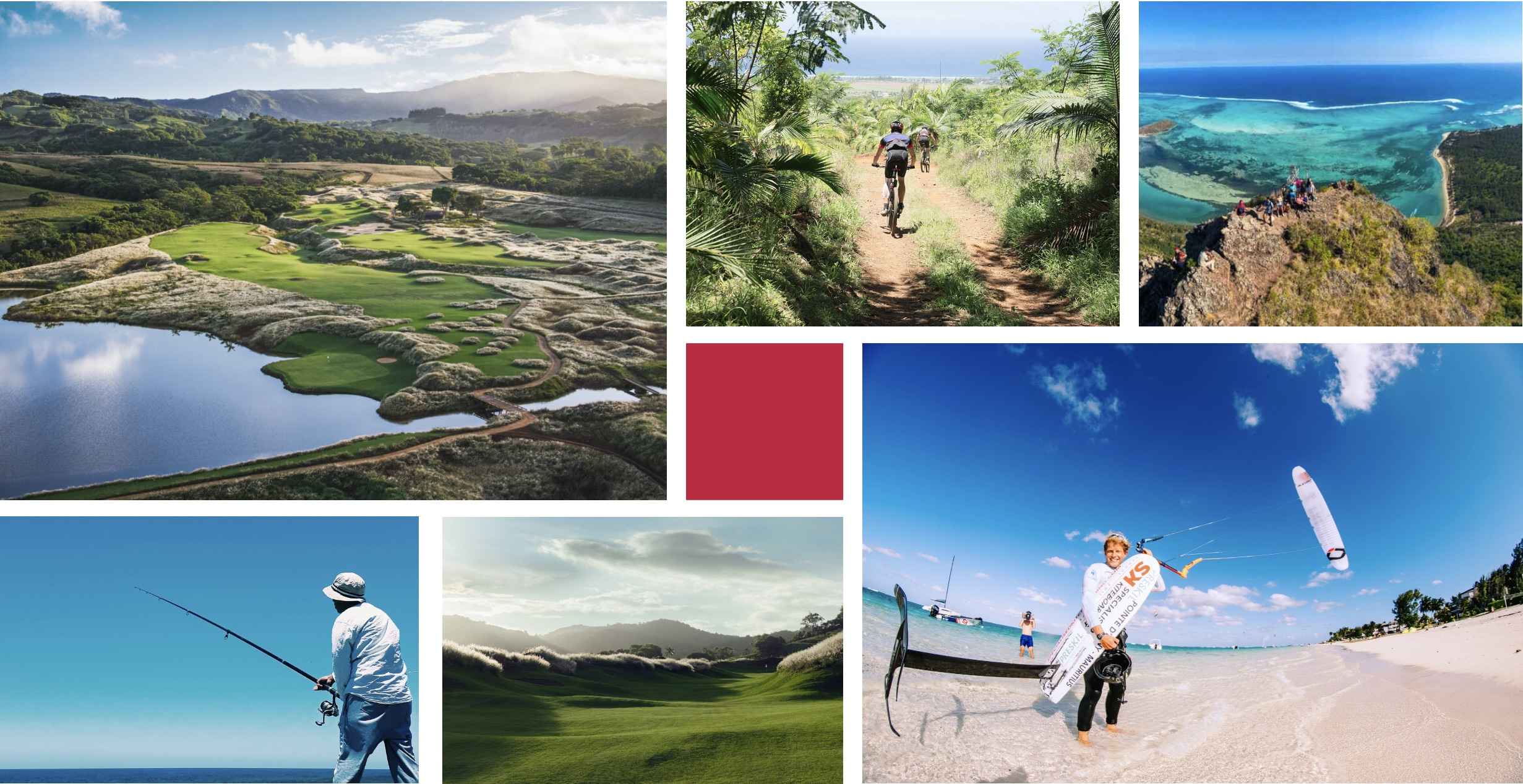

Entertainment

Cinemas, bowling, cultural activities, concerts, plays, exhibitions

GMT+4

Timezone

Lifestyle

Bars, restaurants, gyms...

Government measures to facilitate foreign investment

Project Development Scheme (PDS)

The PDS, which has replaced the IRS and RES since 2015, enables the development of high-quality residences with a free waiting list for sale to foreigners. A non-Mauritian can obtain a permanent residence permit when purchasing a residential unit under the PDS scheme once the purchase price exceeds USD 375,000.Integrated Resort Scheme (IRS)

Under the IRS, villas and other freehold residential properties can be sold at a minimum price of USD 375,000 to non-Mauritians who, following purchase, receive a residence permit. The few IRS projects that have come onto the market have proved very popular and continue to do so, offering luxury facilities to residents. These may include a golf course, marina, wellness center, restaurants, boutiques and many other high-end amenities.Real-Estate Scheme (RES)

RES properties can be sold to citizens and non-citizens alike, with no minimum price. However, the acquisition of a property worth at least USD 375,000 entitles the foreign buyer to a residence permit. This program is generally smaller than other real estate projects and is aimed primarily at investors, retirees and professionals who want to invest, work and live in Mauritius, or those who want to enjoy a vacation in Mauritius.Smart City Scheme (SCS)

The SCS is developed on at least 21 hectares (50 acres) of land and must adhere to the concept of living, working and playing. In its implementation, it includes numerous regulations enabling the development of urban spaces, favoring pedestrian life. All SMS properties are available for purchase by foreigners from Mauritius.R+2 apartments

R+2 is a real estate concept enabling foreigners to purchase an apartment that is not part of a PDS, IRS or RES development. This purchase does not give foreigners permanent residency, but it does provide them with a 6-month multiple-entry visa valid for 5 years, and gives them the opportunity to rent out the property, thereby benefiting from a rental return.Invest Hotel Scheme (IHS)

The IHS scheme was designed to enable hotels to sell their rooms, suites or villas forming part of the hotel to purchasers, whether before, during or after construction of the hotel. Not only does it enable purchasers to generate rental income, it also offers access to all the services of a luxury hotel.Easier property acquisition for residents of Mauritius

Occupation and Resident Permit holders can now own their principal residence outside traditional schemes such as IRS, PDS, RES, R+2 and Smart City.

Property criteria

You can acquire a residential property built on a plot of up to 0.5276 hectares, a bare plot, or a serviced plot not exceeding 0.5276 hectares.

Price and taxes

The property must be worth at least 500,000 USD.

Soft taxation

- A single tax rate of 15% for individuals and companies.

- No inheritance tax.

- No capital gains tax on resale of the property.

- No property tax, no council tax.

- Free repatriation of profits, dividends and capital.

The profitability of real estate investment in Mauritius

Property investment in Mauritius is estimated to generate a return of between 4% and 10% per year. This higher rate is essentially due to the sector's permeability to economic fluctuations. In other words, investing in real estate in Mauritius allows you to diversify your investments, become a homeowner and benefit from numerous advantages.